The 2022 energy price crisis is leaving thousands of British homes with a stark choice: heating or eating. It’s wrong, unfair and, for reasons outlined in this blog, something we could have mititaged or avoided.

Nothing is more telling of the disjointed nature of energy politics and reality has been the proposed “solution” to the crisis. The UK Government will give £200 to households to help pay their bills this year. The hand out is in effect a loan, placed on millions with poor credit ratings, low amounts of disposable income and often with no capital to invest in energy saving. Some experts do say that this is not technically a loan, merely a levy, but I do disagree. I read it as a means of taking cash from every British billpayer and using that cash to pay off energy companies and wholesale gas suppliers. Using an unfortunate stereotype, what can be more Tory than putting a loan on the poor to pay off fossil fuel providers (even if that payment to fossil fuel companies is indirect).

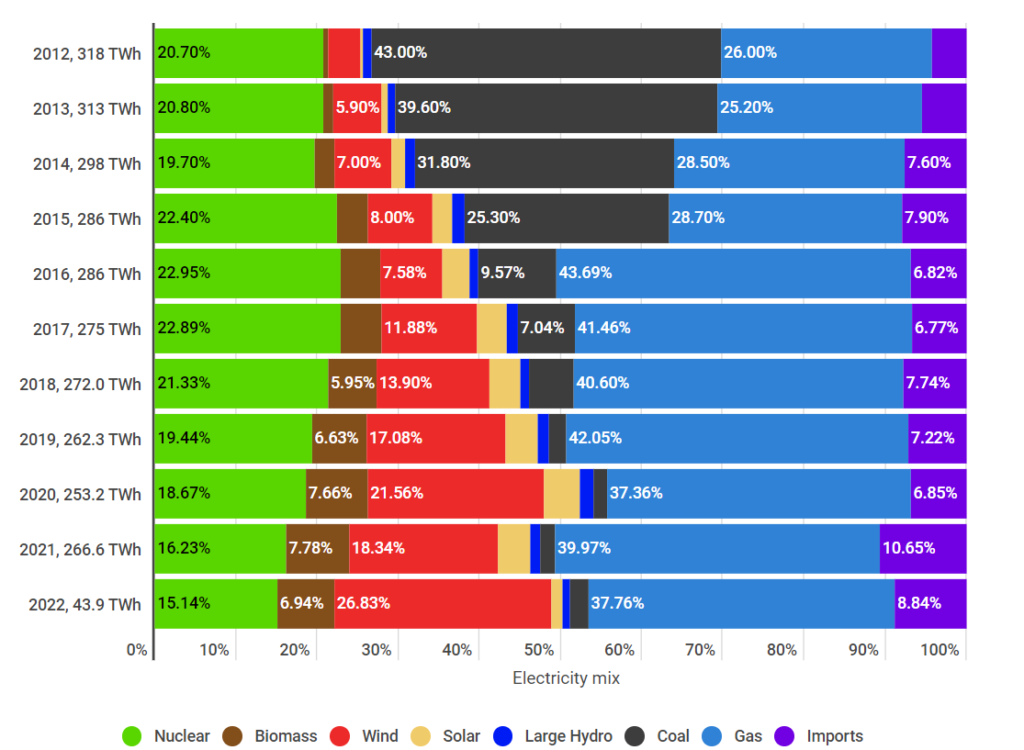

Of course, the energy price crisis was totally predictable. I’ve alluded to it in my presentations, media work and publications for years. It also featured in my book, Decarbonising Electricity: Made Simple. The stark reality is that Britian is addicted to gas and so any price volatility in the gas markets were always going to hit home and hit home hard. In recent history, gas has been the biggest fuel for electricity in Britain (far suppassing nuclear fuels and wind). It’s also responsible for heating most of our homes. We are totally addicted to gas, in a boom that has it’s history in the discovery of North Sea gas and the subseqney “dash for gas” of the 1990s.

Being so dependent on one type of fuel has left Britain critically exposed. Most of our gas is imported, and although politicians may claim that it comes from friendly countries like Norway or Qatar, the reality is that any shock to the world gas markets will have knock on effects to the UK. If Russia stops supplying gas to Germany, don’t expect Germany to sit still. She will start pulling on supplies from exactly where Britian gets her gas from. It will leave us vulnerable in our heavily interconnected and interdependant world. As shown in the chart below, we are still part of a European gas network!

So what could have been done to prevent the international gas prices impacting our bills so acutely? What should and could have been done? Here’s my blueprint of failures:

- Dont sell off storage. The UK has some of the smallest gas storage reserves in Europe. The chart below shows how small our storage is compared to our gas demand. It’s one of the worst in Europe even if one considers we have the second highest gas demand. Comparing Britain to Italy and Germany, who have comparable gas demand shows how stark the gas storage problem is in Britain. Storing gas allows a country to both hedge the gas market pricing, to store gas when it’s cheap and also to ride out price volatility. Of all the countries in Europe, you could argue we have the least resiliancy! This was not always the way. In 2017, and to much protests in the industry, Britain closed the Rough Gas Storage facility which alone could store 41TWh of gas (more capacity than Spain has!)

![Natural gas storage capacity in the UK and European countries presented against annual demand in 2018 Source: [85] Note: Bubble size represents the present storage capacity expressed as a percentage of annual demand](https://www.researchgate.net/profile/Pedro-Machado-8/publication/343392838/figure/fig3/AS:920406571614209@1596453435812/Natural-gas-storage-capacity-in-the-UK-and-European-countries-presented-against-annual.png)

2. Reduce Demand: It’s would be wrong to not mention one of the most important ways of reducing our dependance on gas than by talking about energy efficiency. It is widely known in industry (and often alluded to in the press) that Britain has some of the most inefficient housing in Europe. However, we often fail to reinforce the link between this inefficiency and our energy security and energy poverty.

Britain’s homes bleed heat like it’s a free, unlimited resource. Sadly, heat is not free or unlimited. Our otherwise cold, damp homes get heat from, yes you guessed it… gas! This mostly imported resource is responsible for saving most of us from freezing in the winter. So how can a country famed for it’s bad weather be left with such inefficient housing?

In my view, policy has failed to address that to improve insulation is disruptive, complex and expensive. People don’t insulate for at least one of those three factores. For example, the poorest can’t afford to invest in insulation. Those who can afford it might rather have a holiday than to invest in 280mm of loft insulation. And let’s face it, who wants disruption from insulating their walls (trust me it’s disruptive as I am doing it myself right now!).

A policy based solution needs to be found, or we risk making the challenge of heat several times larger than it needs to be. Insulating my home should reduce heat demand from 25,000 kWh per year to less than 9,000. That reduces my bills and also reduces my reliance on gas (either to run a heat pump or a boiler). Policy has to find a way!

3. Diversification: Gas remains the largest source of our electricity and heat. As well as reducing demand for gas, we can look to find replacements. That means diversifying our electricity supplies and heating systems. Unfortunately, we’ve had a policy environment which continually stalls investment in renewables just as they get successful.

Solar industry experts call this the “solarcoaster” whereby successful Governments (both in the UK and internationally) put in policies which support and then destroy the industry. In the UK in 2014/15 there was 3.8GW of solar installed providing 1% more of our electricity from lower carbon sources. Yet in 2020/21 just 0.2GW was installed. I’m not saying that solar is the answer to all of our problems, or that we want fields of solar panels, but there’s a missed opportunity domestic solar which can meet 30-50% of our domesitic electricity use. The story of onshore wind has also suffered a boom-bust.

Wouldn’t it be great if we saw a steady, predictable growth of renewables and policy that targetted a mix of installations that reduce bills and diversify supply.

It is not just renewables that have suffered. In 1995, Britain commissioned our last nuclear power station, Sizewell B. Britain developed the skills to use nuclear power for commercial electricity production from the one of the first reactors at Calder Hall/Sellafield. But in 1995 we stopped building the power stations. The result was a bleed and steady retirement of the highly specialist skills needed to build power stations. Roll on 2018 and Britain had to turn to France and China for much of the skills and finance to build her latest nuclear plant, Hinckley C. To rub salt into the wound, Hinckley comes in at inflation busting pricing. One wonders what would have happened if there had been a rolling programme of nuclear power stations from Sellafield to today. Local skills? Certainly. Cheaper electricity, probably!

Of course in this whole mix is diversification of gas to hydrogen or other synthetic fuels. That might be part of the answer to securing our heat supplies… keep an open mind to hydrogen!

4. Keeping Coal. There is an awful myth that gas is a clean fuel. It may have a lower carbon intensity than coal but it still has an unsustainable effect on our climate. Britian has closed coal power stations and replaced them (in part) with gas power plants. Doing so in the name of climate has created great headlines, but in my view this was a massive policy failure. Firstly, replacing coal for gas in the name of climate is like asking to be shot in the chest or in the leg. In both cases you die, but by being shot in the leg it just takes longer. I apologise for such a crude analogy, but it just goes to show that gas really is a terrible climate choise. Secondly, closing coal power plants takes away a backup in the event of gas power being unavailable or gas supplies running out. Imagine if a war cuts off international gas supplies – would it not be useful to have an alternative fuel source? Coal is very easy to store!

I am not at all advocating a return to buring coal 24/7. However, I do feel that to have the coal power stations on standby with large coal stocks would be a fantastic hedge against rising gas prices. If things get bad you can at least turn on coal. By blowing up our coal power plants we’ve lost perspective and one of our options.

I think it is so very sad how politics has somewhat missed the fundamentals of an all out persuit of energy security.

So what next for Britain? Great scientific achievements in fusion may one day save the day. We might miraculously find a new source of gas to keep the lights on. We might, hopefully divest to a hydrogen based economy. Either way, Britain has a problem right now. We are now in an all out war to kick gas off our energy system within the decade. I have faith in our creativity and geopolitical nouse to hopefully do the right thing and end the addition to gas.